This article will go through the different types of taxes and will explain where the incidence of taxes lies. Furthermore, the article will outline how the price elasticity of demand and supply can affect the incidence of tax.

Welcome to Simply Economics. This article is the thirteenth in a series to explain economics to those who want to broaden their scope of the subject. Click here to find out more about the series.

WHAT IS A TAX?

A tax is a charge imposed by the government on products and capital. The reason why governments impose taxes is to raise funds for government spending. Governments spend money to supply merit goods that the private sector will not.

TYPES OF TAXES

There are 2 types of taxes:

- Direct tax – A direct is imposed on a certain person or organisation. They are paid on the income of the individual or company. An example of this is co-operation tax where a percentage of a company’s profits are taxed by the government.

- Indirect tax – An indirect tax is imposed on the consumption of goods and services. There are two main types of indirect taxes:

- Specific

- Ad valorem

AD VALOREM TAXES

An ad valorem tax is levied as a percentage of the goods. An example of an ad valorem tax is VAT, which is 20% in the UK. The quantity of tax is dependent upon the value of the good being bought.

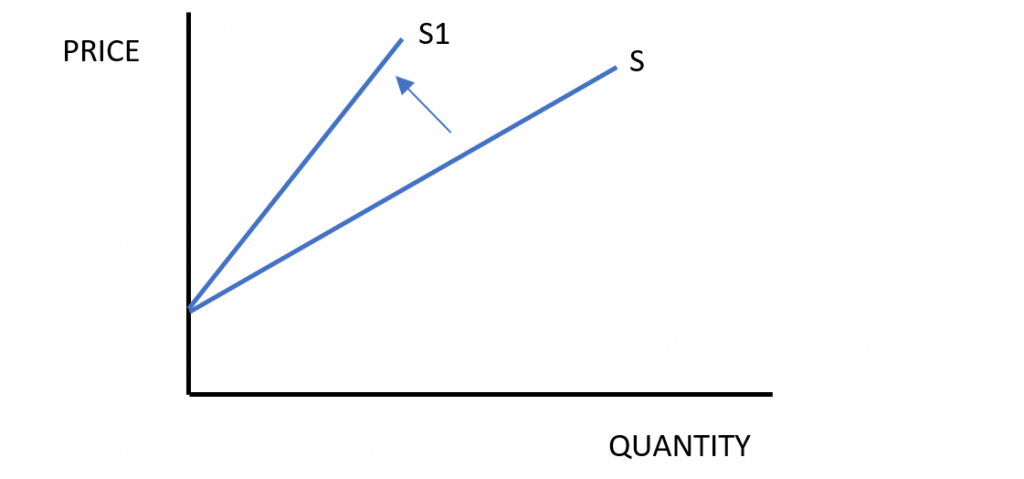

The ad valorem tax causes a pivoted inward shift in supply and not a direct inward shift as shown below. This is because the size of ad valorem tax varies with output i.e. as output increases so does the tax and as output decreases so does ad valorem tax.

SPECIFIC TAX

A specific tax is added to the price of a good and therefore is not variable with output. An example of this is an excise duty which is usually applied on alcohol and petrol.

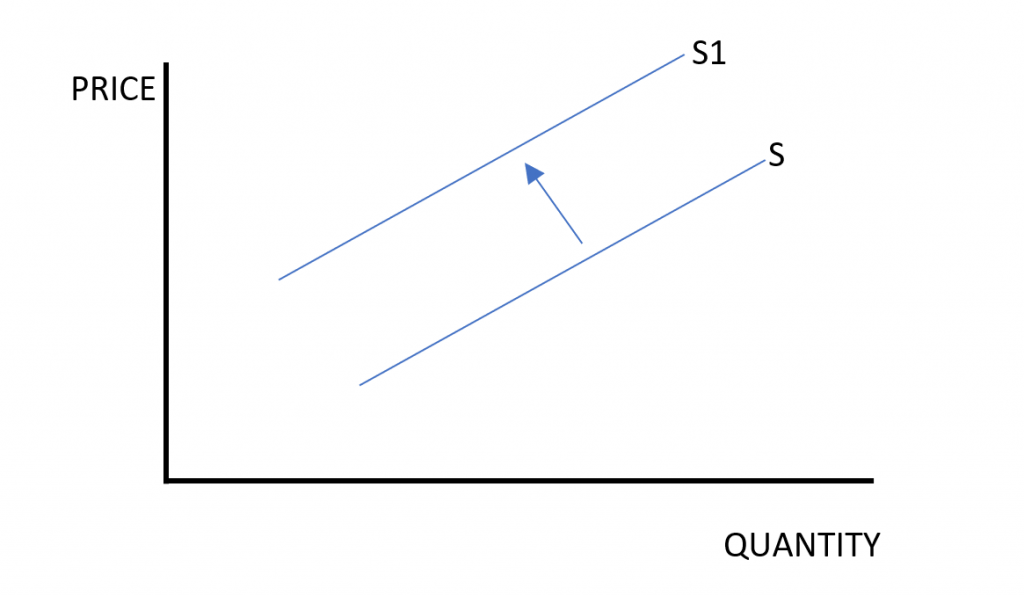

The specific tax causes a normal inward shift in the supply curve of a good as shown below.

INCIDENCE OF TAX

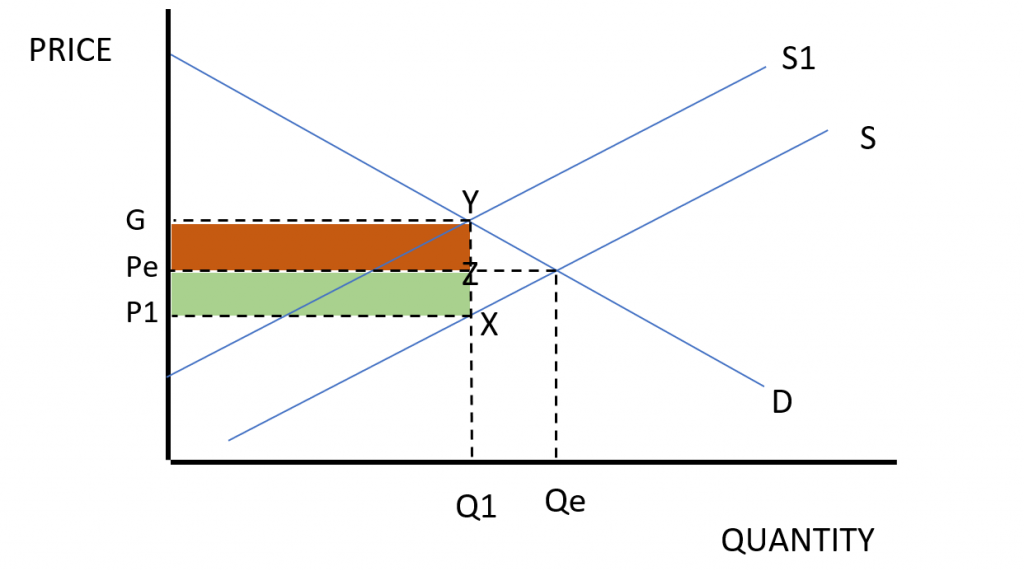

Tax is usually paid by both consumers and producers. However, the quantity of the tax that is paid by consumers and producers is dependent upon the price elasticity of demand and supply of the good.

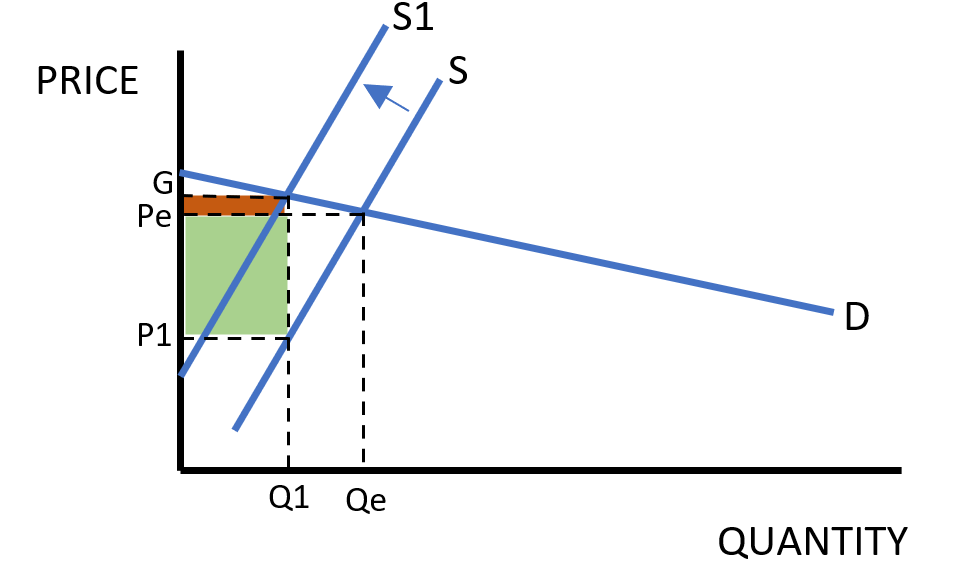

Figure 1 shows how the incidence of tax is shown by a demand and supply diagram. The orange area, DYZPe is the consumer tax i.e. the amount of tax consumers must pay at the equilibrium level. The green area is the amount of tax the producers must pay to supply the good at that price.

THE EFFECT OF PRICE ELASTICITY OF DEMAND AND SUPPLY ON THE INCIDENCE OF TAX

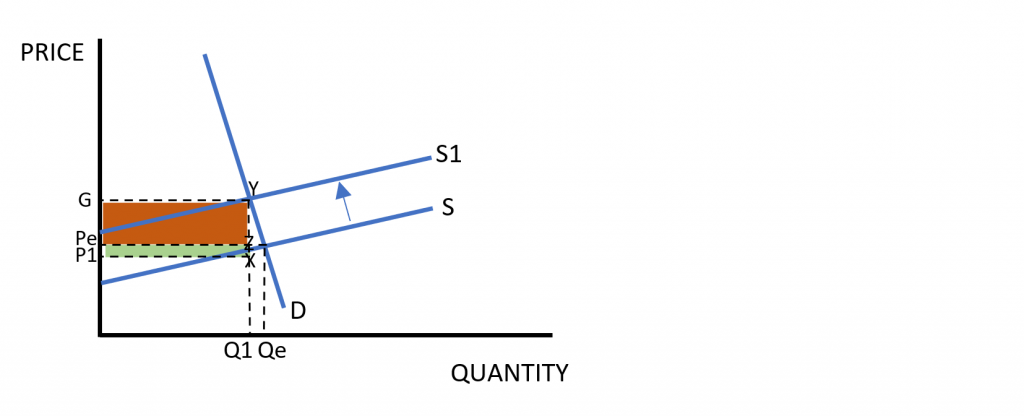

The amount of tax that is paid by the consumer and the producer is dependent upon the price elasticity of supply and demand. For example, if demand is inelastic and supply is elastic to the price of the good then most of the tax will fall upon the consumer as shown below in figure 2

As shown by figure 2 most of the tax burden is on the consumer. This is because producers are able to place most of the tax onto the consumer through higher prices because demand is inelastic which mean that the increase in revenue that the producer will gain through higher prices will outweigh the loss in revenue due to a fall in demand. (Click here to learn more about price elasticities).

However, if a good has elastic demand and inelastic supply then most of the tax will be placed on the producer, as shown below by figure 3.

As shown by figure 3 most of the tax burden is on the producer. This is because producers are not able to raise prices too much because demand is elastic and therefore if there is an increase in price then a loss in revenue due to a fall in demand will be much greater than the gain in revenue due to higher prices. Hence, most of the tax must be paid by the producer.

In conclusion, there are 2 types of tax; direct and indirect taxes. Indirect taxes are split into two categories; ad valorem and specific. Ad valorem tax is taken as a percentage of the good sold and specific tax is taken at a constant rate of the product. Lastly, the incidence of tax is dependent on the elasticity of demand and supply of the good.

Feel free to ask any questions and sign up below for the latest updates. Click here for more articles. For more articles in the Economics for Beginners series, click here.

What is Quantitative Easing (QE)

This article will explain the key concepts of Quantitative Easing. It will explain how Quantitative…

11. Taxes

This article will go through the different types of taxes and will explain where the…

10. Consumer and Producer Surplus

This article will explain consumer and producer surplus are and will also discuss the impact…

What are shares and why buy them?

What are shares and why buy them? This article will explain why people buy shares…

4. Balance of Payments

Balance of payments. The UK balance of payments current account for Q1 (2020) is sitting…

3. Employment and Unemployment

Employment and unemployment. This article will explain what unemployment is and how it is measured….

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me…

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

why need a tax function?

A tax function refers to the relationship between the tax rate and the amount of taxable income. It represents how the government collects revenue from its citizens through the tax system. The tax function is important because it helps the government finance its activities and carry out its responsibilities, such as providing public goods and services, maintaining law and order, and promoting economic growth. The tax function is used to design and implement tax policy. It is used to determine the tax rate that would generate the revenue needed to fund government spending and to achieve other policy objectives, such… Read more »

Your article helped me a lot, is there any more related content? Thanks!